Recruitment of Specialist Cadre Officer on a regular basis is now open, as advertised under Advertisement No: CRPD/SCO/2024-25/05. The online registration of applications and payment of fees can be done from the 7th of June 2024 to the 27th of June 2024. State Bank of India is seeking applications from Indian citizens for appointment to various Specialist Cadre Officer positions. Interested candidates are urged to apply online using the link provided on the Bank’s official website.

SBI Trade Finance Officer Recruitment 2024 Important Dates

| Organization | State Bank of India |

| Post Name | SBI Trade Finance Officer (MMGS-II) |

| Vacancies | 150 |

| Eligibility | Graduate degree |

| Experience | 2 Years |

| Grade | Middle Management |

| Age | 23 to 32 |

| Place of Posting | Hyderabad & Kolkata |

| Selection Process | Shortlisting & Interview |

| Notification | PDF Download |

| Official Website | Click here |

SBI Trade Finance Officer Recruitment Qualification 2024

Academic Background: The applicant must hold a Bachelor’s degree from a recognized government university or institution, regardless of the field of study, as well as a Forex certificate from IIBF. Additionally, candidates with a Certificate for Documentary Credit Specialists (CDCS) certification, or qualifications in Trade Finance or International Banking are encouraged to apply.

Work Experience: Candidates should have a minimum of 2 years of experience in Trade Finance processing, acquired after obtaining their essential academic qualifications, while serving in a supervisory capacity at a Scheduled Commercial Bank.

Essential Skills: The ideal candidate should possess exceptional communication, presentation, and processing abilities.

SBI Trade Finance Officer Selection Process 2024

Shortlisting is not guaranteed by merely meeting the minimum qualifications and experience; it is at the discretion of the bank’s shortlisting committee. The committee sets the parameters for shortlisting and selects an appropriate number of candidates for interviews. The bank’s decision to invite candidates for interviews is final, and no correspondence will be entered into on this matter. The interview carries a total of 100 marks, and the qualifying score will be determined by the bank. There will be no further correspondence regarding the interview criteria.

SBI Trade Finance Officer Recruitment Merit List 2024

The merit list for selection will be meticulously prepared in descending order, based solely on the scores obtained in the interview, ensuring transparency and fairness in the selection process. In the event that multiple candidates score the cut-off marks (common marks at the cut-off point), these candidates will be further ranked according to their age in descending order within the merit list, ensuring that the most qualified candidates are chosen for the position.

SBI Trade Finance Officer Recruitment Call Letter 2024

Once your application is reviewed, successful candidates will be notified of the interview details through an official email or by accessing the bank’s website. Please note that a physical copy of the interview call letter will not be issued, so it is important to regularly check your email inbox or the bank’s website for updates.

SBI Trade Finance Officer Recruitment Job Profile 2024

Examining Trade Finance Documents: Thoroughly reviewing all trade finance-related paperwork (such as Letters of Credit, Collections, Bank Guarantees) to ensure compliance with the guidelines set forth by the Bank, RBI, ICC, FEDAI, and other regulatory bodies. Providing assistance and guidance to junior staff at the Central Processing Center, branch front office, and customers as needed.

Processing Trade Finance and Forex Transactions: Handling Trade Finance and Forex transactions centrally for all branches to ensure accurate and timely processing according to established benchmarks. Reconciling Trade Finance and Forex entries across the Bank’s systems and IDPMS/EDPMS. Performing any additional duties associated with the Bank’s Trade Finance and International Business back-office operations.

SBI Trade Finance Officer Recruitment Salary Structure 2024

The position offered is for Middle Management Grade Scale – II, with a probation period of 6 months. The pay scale for this role ranges from Rs 48170 to Rs 69810, subject to revision, which will be applicable from the date of joining. In addition to the base salary, the official will be eligible for various benefits including Dearness Allowance (DA), House Rent Allowance (HRA), City Compensatory Allowance (CCA), Provident Fund, Contributory Pension Fund (NPS), Leave Fare Concession (LFC), Medical Facility, and other perquisites as per the rules in force at that time.

How to apply online for SBI Trade Finance Officer Recruitment 2024?

To access the latest job openings at the State Bank of India, visit their official website at https://bank.sbi/careers/current-openings. Once on the page, scroll down until you find the specific advertisement numbered CRPD/SCO/2024-25/05. Click on the advertisement to download and carefully read the detailed information provided. If you decide to apply, you can do so online through the portal. Before making the final submission of your application, make sure to review it thoroughly as corrections will not be permitted after the submission is complete.

Table of Contents

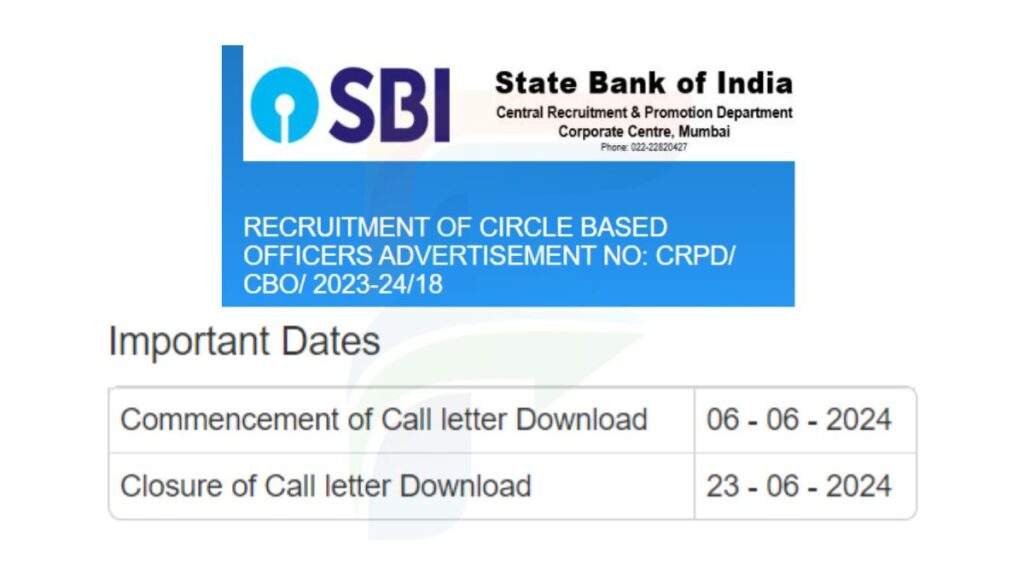

The SBI CBO Result for the year 2024 has recently been made available to candidates on 6th June on the official website sbi.co.in. Aspirants seeking to view the SBI CBO Online Test Result for 2024 can easily access it through a provided direct link. The SBI conducted the CBO exam on 21st January 2024 to fill 5447 (including 167 backlog vacancies) vacant positions for Circle Based Officers (CBO) nationwide.

Apart from the result announcement, the SBI CBO Result also includes the interview call letter for the Online Test, comprising both Objective and Descriptive questions. Successful candidates will be able to download their interview call letter, indicating their qualification for the next round. On the contrary, candidates encountering difficulties in accessing their call letter may not have met the requirements to proceed to the interview phase.

SBI CBO Result 2024 Important Date

| Exam Name | SBI CBO |

| Post Name | Circle Based Officers |

| Organization | State Bank of India |

| Post Date | 22 Nov 2024 |

| Latest Update | 06 Jun 2024 |

| Total Vacancy | 5280 |

| Interview Date | 4th week of June |

| Closure of Call letter Download | 23 Jun 2024 |

| Qualification | Any Degree |

SBI CBO Age Limit 2024

The age limit for the SBI CBO 2024 recruitment is set between 21 to 30 years as of 31st October 2023. This means that candidates applying for this position must not be below 21 years old and must not exceed 30 years at the cutoff date, which is 31st October 2023. This implies that applicants should have been born no later than 31st October 2002 and no earlier than 1st November 1993, including both these dates.

There are specific relaxations provided in the upper age limit for different categories. Scheduled Castes and Scheduled Tribes are eligible for a 5-year age relaxation. Other Backward Classes (Non-Creamy Layer) have a relaxation of 3 years in the upper age limit. Persons with Benchmark Disabilities (PwBD) have varying age relaxations based on their category; PwBD (SC/ST) get a 15-year relaxation, PwBD (OBC) get a 13-year relaxation, and PwBD (Gen/EWS) get a 10-year relaxation.

Additionally, ex-servicemen, including Commissioned officers like Emergency Commissioned Officers (ECOs) and Short Service Commissioned Officers (SSCOs) who have completed 5 years of military service and were released upon completing their assignment are eligible. This also includes those whose assignment is due to conclude within a year from the last date of application submission. These relaxations aim to provide opportunities to a diverse range of candidates based on their backgrounds and experiences.

SBI CBO Selection Process 2024

The selection procedure includes an Online Examination, Screening, and Interview.

- Online Examination: The online assessment will comprise of Objective Tests worth 120 marks and a Descriptive Test worth 50 marks. Following the Objective Test, the Descriptive Test will be conducted, where candidates will be required to type their responses on the computer.

Get ready for the challenge of the objective test! This assessment spans over a period of 2 hours and is divided into 4 distinct sections, with a total of 120 marks up for grabs. Each section has its own designated time slot to ensure fairness and efficiency.

Section I is the English test, featuring 30 questions with a maximum score of 30 marks, to be completed within 30 minutes. Next up is Section II, focusing on Banking Knowledge, comprising 40 questions worth 40 marks, to be tackled in 40 minutes. Section III delves into General Awareness and Economy, with 30 questions carrying 30 marks to be answered in a 30-minute timeframe. Finally, Section IV assesses Computer Aptitude through 20 questions worth 20 marks in a concise 20-minute duration.

In total, you have 2 hours to navigate through the 120 questions across all sections and secure a maximum of 120 marks. Good luck!

The Descriptive Test lasts for 30 minutes and focuses on assessing English language proficiency through Letter Writing and Essay tasks. It consists of two questions worth a total of 50 marks, with no sectional qualifying requirements. The minimum aggregate qualifying marks will be determined by the Bank. Unlike the Objective Tests, there is no penalty for incorrect answers, and sectional marks are not applicable in the Online Examination.

- Screening: Upon successful completion of the online examination, candidates will undergo a rigorous screening process conducted by the Bank’s Screening Committee to ensure compliance with the specified experience criteria for the Scale-I Generalist Officer position at the State Bank of India.

- The Committee will meticulously compare the candidates’ submitted job profiles (authenticated by their current or previous employer(s)) with the requirements of the Scale-I Generalist Officer role. Any significant disparities between the candidate’s job profile and that of the Scale-I Generalist Officer will result in immediate rejection of the application.

- The Bank retains the discretion to establish suitable parameters for aligning the candidates’ job profiles with the position’s requirements. The Bank’s decision in this matter is conclusive and binding for all applicants, with no room for further appeals or discussions.

- A merit list will be compiled based on the total marks obtained in the Online Test by candidates meeting the experience criteria set by the Screening Committee, categorized by Circle and Category.

- Subsequently, candidates up to three times the number of vacancies in each Circle and Category, contingent upon the availability of qualified individuals, will be invited for interviews starting from the top of the merit list. It is crucial to note that qualifying in the online examination does not guarantee an interview opportunity.

SBI CBO Interview Process 2024

The interview component holds a weightage of 50 marks, which is crucial for candidates to secure in order to advance to the final selection stage. The specific minimum qualifying marks for the interview will be determined by the Bank itself.

For candidates falling under the ‘OBC’ category, it is mandatory to furnish an OBC certificate that includes the ‘Non-Creamy layer’ stipulation. Those individuals who identify as OBC but fail to provide the requisite OBC ‘Non-Creamy layer’ certificate and subsequently seek consideration under the General category will not be accommodated.

Likewise, candidates qualifying for the interview under the EWS category must present an EWS certificate that indicates their gross annual income for the financial year 2022-23, following the guidelines set by the Department of Personnel and Training (DoPT). Candidates who have designated themselves as EWS but do not supply the necessary EWS certificate reflecting their gross annual income for the financial year 2022-23 in line with DoPT guidelines and then opt for consideration under the General category will not be accommodated.

SBI CBO Final Selection 2024

Candidates are required to successfully pass both an Online Test and an Interview separately. The scores from the Online Test, including both the Objective and Descriptive sections, will be combined with the Interview scores to determine the final ranking. The final merit list will be compiled by normalizing the marks obtained in the Online Test and Interview, with a weightage of 75% for the Online Test and 25% for the Interview.

The marks achieved by candidates in the Online Test (maximum 170 marks) will be scaled down to a total of 75 marks, while the Interview scores (maximum 50 marks) will be converted to 25 marks. The ultimate merit list, categorized by region and group, will be established by totaling the converted marks from the Online Test and Interview out of a possible 100. Selections will be made from the highest-ranking candidates in the merit list organized by region and category.

SBI CBO Announcement of Results 2024

- The Bank’s website will provide updates on the outcomes for candidates invited for interviews and final selection.

- Successful candidates must also meet the requirement of passing a proficiency test in the specified local language they selected, if applicable, as explained earlier.

Basic Salary of SBI CBO 2024

Currently, the initial salary stands at 36,000/- within the range of 36000-1490/7-46430-1740/2-49910-1990/7-63840 for Junior Management Grade Scale-I, along with 2 additional increments (for a tenure of 2 years or more in an officer position in a Scheduled Commercial Bank/ Regional Rural Bank). The employee will also receive Dearness Allowance, House Rent Allowance/ Lease rental, City Compensatory Allowance, Medical benefits, and other entitlements as per the prevailing regulations.

SBI CBO: Documents to Submit at Interview

Candidates invited for an interview must bring a photo ID proof such as Passport, Aadhar, PAN Card, Driving License, Voter’s ID Card, Bank Passbook with certified photo, School or College ID, or a Gazetted Officer’s ID on official letterhead in original and a self-attested photocopy. The photocopy of the ID should be submitted with the call letter; otherwise, the candidate may not be allowed to take the test if their identity is uncertain. Additionally, candidates must bring copies of all relevant documents, original copies, and the interview call letter for verification. Failure to comply or doubts regarding the candidate’s identity may result in not being permitted to attend the interview.

SBI CBO Vacancy Details 2024

| State | Total |

| Gujarat | 430 |

| Dadra & Nagar Haveli | |

| Daman & Diu | |

| Andhra Pradesh | 400 |

| Karnataka | 380 |

| Madhya Pradesh | 450 |

| Chhattisgarh | |

| Odisha | 250 |

| Jammu & Kashmir | 300 |

| Ladakh | |

| Himachal Pradesh | |

| Haryana | |

| Punjab | |

| Tamil Nadu | 125 |

| Pondicherry | |

| Assam | 250 |

| Arunachal Pradesh | |

| Manipur | |

| Meghalaya | |

| Mizoram | |

| Nagaland | |

| Tripura | |

| Telangana | 425 |

| Rajasthan | 500 |

| Uttar Pradesh | 600 |

| West Bengal | 230 |

| A & N Islands | |

| Sikkim | |

| Maharashtra | 300 |

| Goa | |

| Maharashtra | 90 |

| Delhi | 300 |

| Uttarakhand | |

| Haryana | |

| Uttar Pradesh | |

| Kerala | 250 |

| Lakshadweep |

Table of Contents

The highly anticipated final results for the State Bank of India (SBI) Specialist Cadre Officer 2024 exam have been officially released, bringing an end to the suspense and excitement that has surrounded this prestigious banking recruitment process. This outcome marks a significant milestone for the successful candidates who have gone through the rigorous selection process and demonstrated their expertise and capabilities in specialized areas of the banking industry.

The announcement of these results not only signifies the culmination of months of hard work and dedication for the candidates but also highlights the commitment of the SBI to recruiting top talent to drive innovation and excellence in the financial sector.

SBI Specialist Cadre Officer Important Dates 2024

| Post Name | SBI Specialist Cadre Officer |

| Vacancies | 439 |

| Call Letter | 24 Jan to 02 Feb 2024 |

| Interview Date | 30 Jan to 03 Feb 2024 |

| Application Last Date | 21 Oct 2023 |

| Application Start Date | 16 Sep 2023 |

| Official Website | Click here |

SBI Specialist Cadre Officer Application Fee 2024

For the recruitment of Specialist Cadre Officers at State Bank of India in the year 2024, the application fee varies based on the candidate’s category. General, OBC, and EWS candidates are required to pay an application fee of Rs.750, which can be conveniently submitted through online payment modes like Debit Card, Credit Card, or Internet Banking. On the other hand, candidates from SC, ST, and PwD categories are exempted from paying any application fee, making the application process more accessible and equitable for all interested candidates.

SBI Specialist Cadre Officer Age Limit 2024

The age limit for candidates applying for the SBI Specialist Cadre Officer positions in 2024 varies depending on the specific role. For the Assistant Manager position, the maximum age limit is 32 years, while for the Deputy Manager role, it is 35 years. Candidates aspiring to be Chief Managers can apply up to the age of 42, and for those aiming for the Assistant General Manager position, the maximum age limit is set at 45 years. It is worth noting that age relaxation is applicable as per the rules and guidelines provided by the organization.

SBI Specialist Cadre Officer Qualification 2024

For those aspiring to be an SBI Specialist Cadre Officer, it is required that candidates hold a Bachelor’s degree in Computer Science, Computer Science & Engineering, Information Technology, Electronics, Electronics & Communications Engineering, Software Engineering, or any equivalent degree in the specified disciplines. Alternatively, candidates can also possess a Master’s degree in Computer Applications (MCA) or a Master’s degree or M.Sc. in Computer Science, Computer Science & Engineering, Information Technology, Electronics, or Electronic & Communications Engineering.

SBI Specialist Cadre Officer Salary Structure 2024

Post Serial Number No 1 to 10, No 13, and No 15 to 17 fall under Grade JMGS I with a basic pay structure of 36000-1490/7-46430-1740/2-49910-1990/7/-63840. Post Serial Number No 11 to 12, No 14 & 18, and No 29 to 37 are classified under Grade MMGS II with a basic pay scale of 48170-1740/1-49910-1990/10-69810.

Moving on to Post Serial Number No 38 to 44, the designated Grade is MMGS III with a basic pay arrangement of 63840-1990/5-73790-2220/2-78230. For Post Serial Number No 19 & No 45, the Grade allocated is SMGS IV, entailing a basic pay structure of 76010-2220/4-84890-2500/2-89890. Lastly, Post Serial Number No 20 falls under Grade SMGS V with a basic pay setup of 89890-2500/2-94890-2730/2-100350.

Officers who are actively involved on a consistent basis will qualify for various benefits such as DA, HRA, CCA, PF, Contributory Pension Fund (NPS), LFC, Medical Facilities, and other perks in accordance with the prevailing regulations. They will receive a salary and additional benefits based on the bank’s established salary framework.

Table of Contents